The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) was signed on March 27th, 2020 to assist those who experienced economic hardship as a direct result of the COVID-19 pandemic. Approximately $14 billion of the CARES Act funding was provided to the Office of Postsecondary Education as the Higher Education Emergency Relief Fund (HEERF).

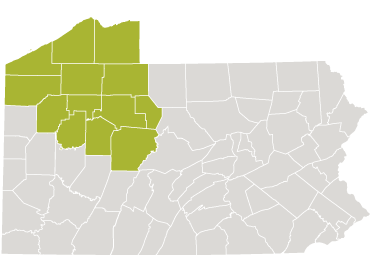

In April 2020, the UPMC Schools of Nursing (SON) completed applications to participate in the three programs made eligible to our institution.

Program: HEERF Student Aid Portion

Cares Act Section: 18004(a)(1)

Eligibility: All Title IV participating schools

Note: Students cannot apply for assistance directly from the U.S. Department of Education but should contact their institutions for further information and guidance.

View the allocation table.

Program: HEERF Institutional Aid Portion

CARES Act Section: 18004(a)(1)

Eligibility: All Title IV participating schools

View the allocation table.

Program: Fund for the Improvement of Postsecondary Education (FIPSE) Formula Grant

CARES Act Section: 18004(a)(3)

Eligibility: Public and private nonprofit institutions of higher education that are eligible under Part B of Title VII of the HEA and received less than $500,000 total from HEERF (a)(1) and (a)(2) programs

View the allocation table.

CARES ACT SECTION 18004(a)(1): HEERF Student Aid Portion

What is the HEERF Student Aid portion of the CARES Act?

The HEERF Student Aid funding is a stipend provided directly to students to assist with the expenses related to the disruption of campus operations due to the coronavirus.

Who is eligible for the Student Aid portion?

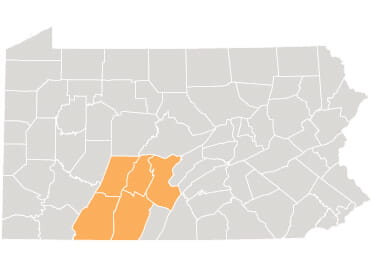

UPMC SON will ensure that all eligible students receive allocated emergency funding provided through the CARES Act. Emergency funds will be distributed to help cover expenses related to the disruption of campus operations due to coronavirus. The UPMC SON has determined the first day of disruption to campus operations to be March 16, 2020. UPMC SON Executive Leadership determined that all students were equally affected by the campus disruptions due to COVID19 and as a result funding will be equally disbursed among all eligible students.

For a student to qualify for CARES Act HEERF Student Aid funding, the UPMC SON is requiring all of the following:

- A valid 2019-20 or 2020-21 Free Application for Federal Student Aid (FAFSA) with no unresolved C Flags

- Satisfactory Academic Progress must be met or in a probationary at the time of disbursement

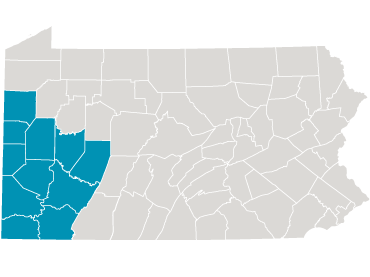

- Active enrollment in the UPMC Mercy School of Nursing Registered Nursing program between the dates of March 16, 2020 and May 07, 2020.

How much funding was allocated to the UPMC Mercy and how much has been distributed to students?

- Total Allocated to: UPMC Mercy SON: $87,812.00

- Total Distributed to UPMC Mercy SON Students as of 12/31/2023: $87,812.00

What are the reporting requirements for the Student Aid portion?

In May 2020, the US Department of Education announced a 30 day reporting requirement for all institutions participating in the HEERF Student Aid program. As of August 31, 2020, the reporting requirement has been changed to a quarterly basis.

All reports can be found via the links below:

CARES ACT SECTION 18004(a)(1): HEERF Institutional Aid Portion

What is the Institutional Aid portion of the CARES Act HEERF?

The US Department of Education granted institutions of higher education the use of up to 50 percent of the funds they receive to cover any costs associated with significant changes to the delivery of instruction due to the coronavirus.

What are permissible expenses under the Institutional Aid portion?

Permissible expenses covered under the Institutional Aid portion include but are not limited to, costs associated with significant changes to the delivery of instruction, costs associated to orders, waivers and safeguards set forth by government officials and/or outstanding expenditures associated to the loss of revenue.

Expenses that will not be covered under the Institutional Aid portion of the CARES Act include payments made to contractors for the provision of pre-enrollment recruitment activities, endowments or capital outlays associated with facilities related to athletics, sectarian instruction, or religious worship.

How much funding was allocated to the UPMC Mercy and how much has been utilized?

- Total Allocated to UPMC Mercy SON: $87,812.00

- Total Distributed to UPMC Mercy SON as of 12/31/2023: $87,812.00

What are the reporting requirements for the Institutional Aid portion?

On October 13, 2020 the US Department of Education released further guidance regarding the reporting requirement for the Institutional Aid funding. All institutions participating in the HEERF Institutional Aid program are required to submit reports on a quarterly basis.

All reports can be found via the links below:

CARES ACT SECTION 18004(a)(3): Fund for the Improvement of Postsecondary Education (FIPSE)

What is the FIPSE portion of the CARES Act?

Additional funding was made available to Public and private nonprofit institutions of higher education that are eligible under Part B of Title VII of the HEA and received less than $500,000 total from HEERF (a)(1) and (a)(2) programs.

How much funding was allocated to the UPMC Mercy and how much has been utilized?

- Total Allocated to UPMC Mercy SON: $324,376.00

- Total Distributed to UPMC Mercy SON as of 12/31/2023: $324,376.00

What are the reporting requirements for the FIPSE portion?

On October 13, 2020 the US Department of Education released further guidance regarding the reporting requirement for the Institutional Aid funding. All institutions participating in the HEERF FIPSE program are required to submit reports on a quarterly basis.

All reports can be found via the links below:

Additional CARES Act HEERF Resources: