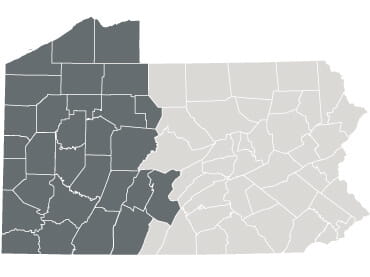

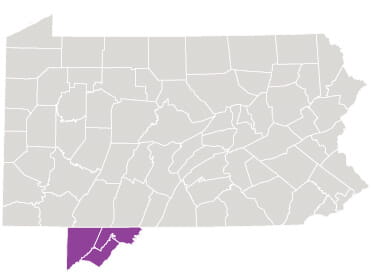

UPMC in central Pa. has partnered with local health organizations to offer network insurance products that lower insurance costs for your organization and out-of-pocket expenses for your employees.

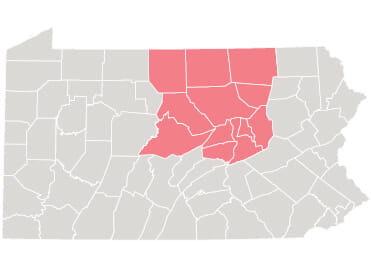

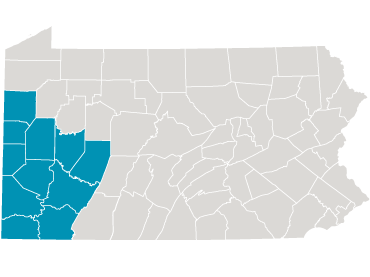

Aetna Whole Health. A PPO product that controls costs and improves quality by using UPMC in central Pa.'s network of doctors, hospitals and outpatient services through a variety of benefit coverage options.

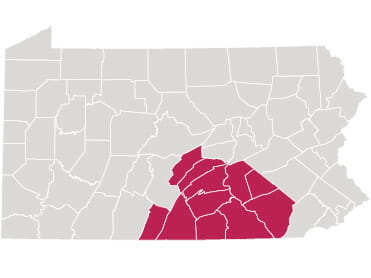

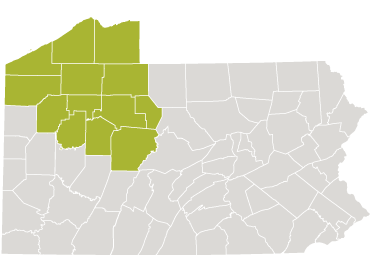

Capital BlueCross CareConnect. A POS product that requires members to select a UPMC in central Pa. primary care physician as their primary care provider. The product also incorporates wellness incentives into its plan design.

These arrangements are available on a fully insured and self-insured basis through a variety of plans designed to meet your insurance needs. Your health insurance advisor or health plan representative will have additional information for you.

UPMC in central Pa. will also work closely with an employer and its health insurance carrier during open enrollment and throughout the year. By working together, we can help ensure that your organization achieves its objectives and your employees improve their health.

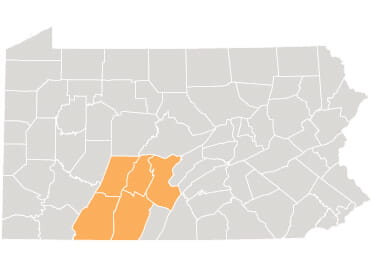

Case Study. UPMC in central Pa. partnered with a local broker to implement a narrow network offering to a family-owned business and its 800 employees. The employer had a long-term relationship with an existing carrier, but health insurance costs were rising significantly. By switching carriers to Capital BlueCross and offering CareConnect, the employer could better control its insurance costs.

After an extensive enrollment campaign, half of all employees enrolled in CareConnect and selected a PCP. Then, the CARES team conducted employee screenings as part of the insurance offering and reported their findings to company management. As a result, the employer gained a better understanding of, and a plan for, the health care needs of its employees.

Need more information?

Phone: 717-231-8018

Request Information