UPMC Content 2

Form 990 is an annual information return that federally tax-exempt organizations must file with the IRS. It provides information on our mission, programs and finances, and includes details of executive compensation. Certain business relationships among officers, directors, key employees and their family members also are detailed in this filing.

Background on UPMC's Form 990 filings for FY2024

As part of our commitment to organizational transparency, UPMC again has filed a group, or consolidated, IRS Form 990 for the fiscal year ended June 30, 2024. This approach is designed to improve the public’s understanding of UPMC’s operations and the relationship among our various entities. Per IRS requirements, executive compensation is reported based on Calendar Year 2023 in the Fiscal Year 2024 return. We also have filed a separate return for the parent organization, UPMC. (Please see UPMC’s most recent audited consolidated financial statements for more details. Click here.)

About UPMC

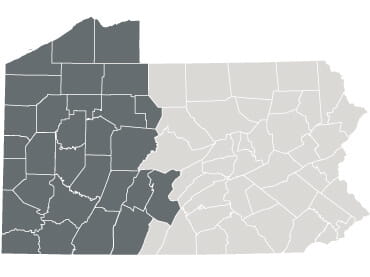

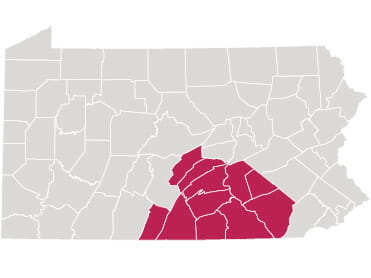

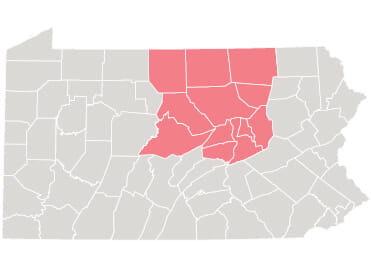

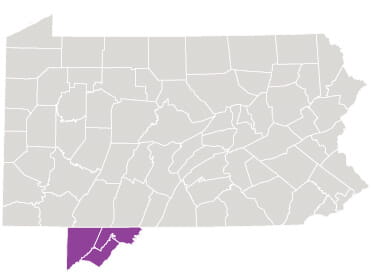

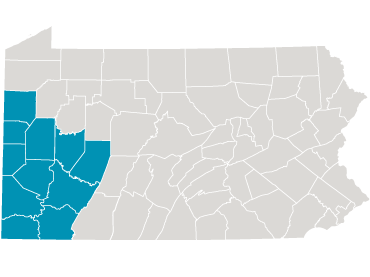

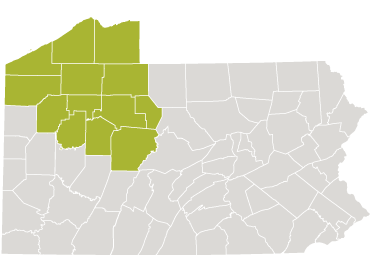

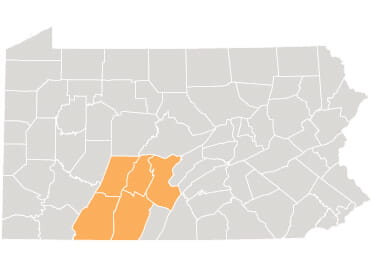

UPMC is a world-renowned, nonprofit health care provider and insurer committed to delivering exceptional, people-centered care and community services. Headquartered in Pittsburgh and affiliated with the University of Pittsburgh Schools of the Health Sciences, UPMC is shaping the future of health through clinical and technological innovation, research, and education. Dedicated to advancing the well-being of our diverse communities, we provide nearly $2 billion annually in community benefits, more than any other health system in Pennsylvania. Our 100,000 employees — including more than 5,000 physicians — care for patients across more than 40 hospitals and 800 outpatient sites in Pennsylvania, New York, and Maryland, as well as overseas. UPMC Insurance Services covers more than 4 million members, providing affordable, high-quality, value-based care. To learn more, visit UPMC.com.